Top ERP Software for Banking and Financial Services in 2025

For institutions aiming to streamline operations and enhance efficiency, the role of Enterprise Resource Planning (ERP) systems has become increasingly vital. As financial organizations navigate rising regulatory demands and competitive pressures, the need for robust and adaptable ERP solutions is more pronounced than ever. These systems integrate various banking processes into a single platform, automating daily tasks, reducing manual efforts, and improving collaboration across departments.

This blog will explore the landscape of ERP systems specifically tailored for banking and financial services. We will discuss the key benefits of ERP systems, essential features to consider, top software options for 2024/2025, and practical tips for successful implementation. By leveraging these insights, banking and financial organizations can position themselves for success in an ever-evolving digital landscape.

Key Benefits of Using ERP in Banking & Financial Services

- Increased Efficiency: ERP systems integrate all banking processes into a single platform, automating daily tasks and reducing manual efforts.

- Enhanced Collaboration: Facilitates smooth collaboration across departments and remote teams, improving overall productivity.

- Improved Data Security: Offers robust security features, including firewalls and monitored access points, to protect sensitive financial data.

- Reduced Operational Costs: Streamlines processes to minimize disruptions and operational expenditures, leading to significant cost savings.

- Regulatory Compliance: Incorporates built-in compliance tools to help banks meet industry regulations and standards effectively.

- Real-Time Data Analysis: Provides real-time insights and reporting capabilities, enabling informed decision-making based on current data trends.

- Scalability: Adapts to the growth of banks, accommodating increased data volumes and user loads as operations expand.

- Efficient Resource Allocation: Optimizes the allocation of human and financial resources through automation of routine tasks.

Must-Have Features for ERP Software in Banking & Financial Services

When selecting an ERP system for banking, it’s essential to focus on key features that address the unique needs of financial institutions:

- Financial Management Module: Look for multi-entity general ledgers that enable seamless reporting across branches. This feature simplifies financial tracking and enhances visibility into overall financial health.

- Regulatory Compliance Tools: Ensure the ERP includes tools like Federal Reserve reporting templates to facilitate compliance with regulatory requirements. These features help streamline the reporting process and keep your institution aligned with industry standards.

- Risk Management Modules: Choose an ERP that offers robust tools for assessing credit risk and managing liquidity. Effective risk management is crucial for maintaining financial stability and ensuring that banks can meet their obligations.

- Data Analytics and Business Intelligence: Opt for systems that provide predictive analytics capabilities. These tools enhance fraud detection and support strategic decision-making by delivering valuable insights into customer behavior and market trends.

Top ERP Software for Banking & Financial Services in 2024/2025

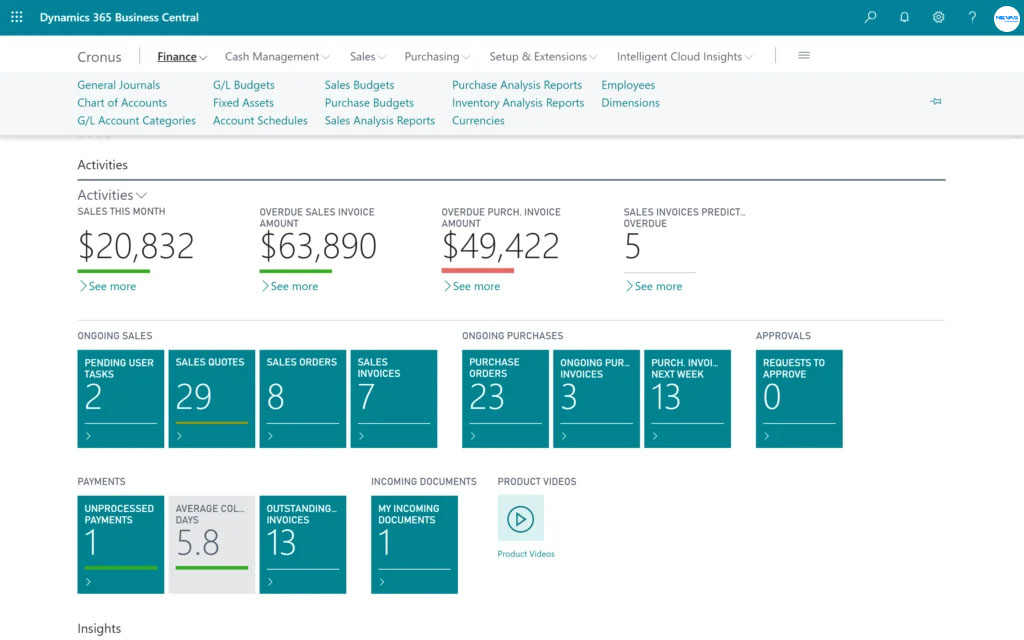

1. Microsoft Dynamics 365 Business Central

Dynamics 365 Business Central offers a user-friendly and highly integrated ERP system. This solution integrates smoothly with Microsoft’s suite of productivity tools, making it a great choice for organizations already using Office 365.

Key Features:

- Utilize advanced artificial intelligence to enhance financial analysis and forecasting, providing deeper insights into past performance and future trends.

- Achieve seamless connectivity with Microsoft applications, including Teams and Outlook, to streamline workflows and improve collaboration.

- Enjoy a user-friendly interface that allows for easy navigation and offers extensive customization options to meet specific user needs.

- Incorporates built-in compliance and auditing tools designed to help organizations adhere to regulatory standards efficiently.

Ideal For: Regional banks and credit unions that prioritize ease of use and integration with Microsoft products.

Dynamics 365 Business Central plans and pricing

Dynamics 365 Business Central Essentials – $70 user/month

Dynamics 365 Business Central Premium – $100 user/month

Dynamics 365 Business Central Team Members – $8 user/month

Learn more about Business Central pricing.

2. Oracle Cloud ERP

Oracle Cloud ERP stands out with its powerful data analytics and machine learning capabilities, making it an excellent choice for large banks. Its modular design allows institutions to customize the platform according to their specific needs while scaling as they grow. With strong features in financial management, risk assessment, and compliance, Oracle helps banks optimize operations and proactively assess market risks.

3. SAP S/4HANA

SAP S/4HANA is designed for large financial institutions that require real-time data processing and advanced predictive analytics. This ERP excels in managing complex financial transactions while ensuring compliance with stringent regulations. Its deep automation capabilities and compliance tools help organizations minimize operational risks and maximize data visibility across multi-branch banking environments.

4. SAP Business ByDesign

SAP Business ByDesign combines powerful analytics with a flexible approach. Its modular design allows for incremental upgrades as organizations grow, making it a sustainable long-term solution suitable for mid-sized financial institutions. The platform’s strong project management capabilities benefit banks with complex reporting needs while maintaining regulatory compliance.

5. NetSuite

NetSuite provides a flexible and scalable ERP solution ideal for growing financial institutions. Its real-time analytics empower banks to make quick decisions based on accurate data, enhancing responsiveness in changing market conditions. The cloud-based architecture allows seamless integration with third-party applications, making it adaptable for institutions needing customizable solutions. With features designed to streamline financial reporting and cash flow management, NetSuite helps banks maintain control over their core operations.

6. Infor

With tools designed for fraud detection and regulatory monitoring, Infor helps banks maintain secure transactions while leveraging AI-driven insights to enhance decision-making capabilities. Infor specializes in predictive analytics and risk management tailored for compliance-focused financial institutions.

7. Sage Intacct

Sage Intacct enhances operational efficiency by automating tasks like reconciliation and reporting, providing real-time insights that improve transparency and accountability.

Sage Intacct is tailored for mid-sized financial institutions that focus on automation and efficient accounting practices. It supports multi-entity and multi-currency environments, making it suitable for global banks.

8. QuickBooks

QuickBooks is known for its intuitive interface and robust cloud-based accounting features, appealing to smaller financial institutions. It allows organizations to monitor their financial health in real time with tools for tracking cash flow and expenses. QuickBooks also offers mobile access, ensuring that financial managers can stay updated on transactions wherever they are.

9. Horizon ERP

Horizon ERP caters to smaller financial institutions with a straightforward approach to financial and payroll management. Its simple design allows teams to navigate easily, focusing on essential accounting and compliance features without the complexity of larger systems. This solution automates basic processes like invoicing and reconciliation, enabling small banks to manage daily financial tasks effectively.

10. AlignBooks

AlignBooks is an affordable ERP solution designed for small banks and financial institutions. Its essential features include billing, GST compliance, and straightforward financial reporting. The platform is user-friendly and supports mobile access, allowing banking staff to manage financial records conveniently while on the go.

11. BUSY Accounting

BUSY Accounting simplifies accounting tasks without the complexity found in larger solutions, making it ideal for community banks focused on managing operational costs effectively. It is a cost-effective ERP system that supports essential financial tracking and budgeting for smaller institutions.

How to Choose the Right ERP Software for Your Financial Institution

Define Your Needs and Prioritize Features

Before selecting an ERP, it’s essential to assess the specific needs of your financial institution:

- Evaluate integration requirements for your current technology stack.

- Consider your institution’s compliance needs and the ERP’s regulatory features.

- Factor in projected growth over the next 3-5 years to ensure scalability.

Technical Considerations

Cloud vs. on-premise deployment options based on security and access needs.

- API integration capabilities to facilitate communication with existing systems.

- Data center compliance with federal standards.

- Disaster recovery and business continuity features for uninterrupted service.

Vendor Evaluation Criteria

Select a vendor with a strong presence in the market:

- Compliance with federal banking regulations.

- Established network of implementation partners.

- Regular updates to stay current with regulatory changes.

ERP Implementation Tips for Banking and Financial Services

Implementing an ERP system can be complex, typically taking 6 to 12 months. To minimize disruption:

- Adopt a phased approach to allow gradual adaptation by teams.

- Integrate regulatory approvals into the project timeline.

- Develop a clear data migration strategy that includes data assessment from legacy systems and compliance with federal retention policies.

Future Trends in ERP for Banking & Financial Services

As we look to the future, emerging technologies are poised to transform ERP systems in the financial sector. Artificial intelligence (AI) and machine learning are improving fraud detection, reducing false positives by up to 50%, while predictive analytics enhance risk assessment and customer insights.

The shift to cloud-based solutions is accelerating, with projections indicating that 75% of financial institutions will adopt cloud ERP by 2025. This trend favors hybrid models that offer both security and flexibility. Additionally, open banking integration is enhancing customer interactions through real-time payment processing and improved analytics.

Partnering with Nevas Technologies can further enhance your ERP journey. With over a decade of experience as a Business Central Implementation partner, Nevas specializes in delivering tailored ERP solutions for financial institutions. Their focus on innovation and customer success ensures you maximize your investment.

If you’re ready to optimize your ERP systems, consider scheduling a demo with Nevas Technologies. Our team is prepared to help you explore solutions that drive growth and success in the evolving digital landscape. For more information on tailored ERP solutions for banking, and financial institutions contact us today.